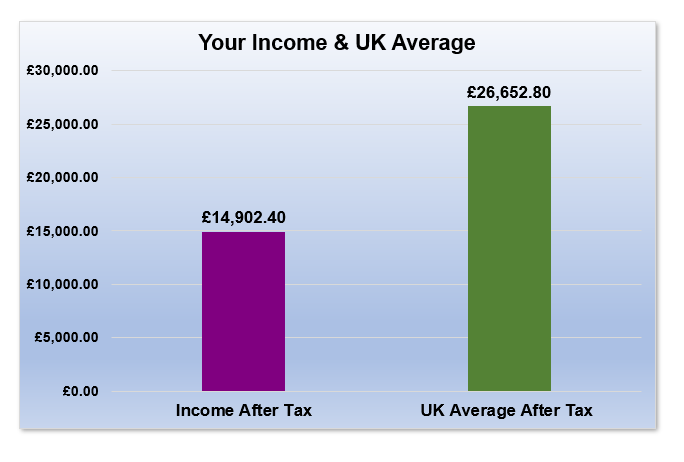

In the UK, an annual salary of £16,000, after tax and national insurance, results in a net income of £14,902.40 for 2023/2024. This equates to approximately £1,241.87 monthly, £286.58 weekly, and £57.32 daily (based on a 5-day workweek).

For more accurate results, use our salary and tax calculator.

Salary Calculator

| YEAR | MONTH | WEEK | DAY | HOUR | |

|---|---|---|---|---|---|

| Gross Wage | £16,000.00 | £1,333.33 | £307.69 | £61.54 | £8.21 |

| Tax | £686.00 | £57.17 | £13.19 | £2.64 | £0.35 |

| National Insurance | £411.60 | £34.30 | £7.92 | £1.58 | £0.21 |

| Net Wage | £14,902.40 | £1,241.87 | £286.58 | £57.32 | £7.64 |

A Full Breakdown of £16,000 After tax

Let’s break down your take home pay from your £16,000 per year salary. Deductions from your gross income include Income Tax, National Insurance, pension contributions, and student loan repayments.

Important Note: Your personal allowance, which you can earn before paying any tax, is £12,570. Any earnings over this amount are taxable income.

The rates shown have been calculated from 6th April for the tax year 2023/2024 and will be the same for people in England, Ireland and Wales. If you live in Scotland, you must use the Scotland salary calculator.

How Much Income Tax (PAYE) On Your £16k Salary

You will pay £1,097.60 per year in income tax from your £16,000 salary. This equates to £57.17 per month or £13.19 per week and £2.64 per day for the tax year 2023/2024.

| Taxable Income | Tax Rate | Band |

|---|---|---|

| Up To £12,570 | 0% | Personal Allowance |

| £12,570 To £50,270 | 20% | Basic Rate |

| £50,270 To £125,140.00 | 40% | Higher Rate |

| Over £125,140.00 | 45% | Additional Rate |

National Insurance (NI) On Your £16k Salary

Your National Insurance contributions on your £16,000 per year salary will be £411.60 per year, or £34.30 per month, £7.92 per week for the 2023/2024 tax year.

| Minimum Wage | Current Rate (April 2022) | Rate From (April 2023) | Increase % |

|---|---|---|---|

| National Minimum Wage: | £9.50 | £10.42 | 9.7% |

| 21-22 Year Old Rate: | £9.18 | £10.18 | 10.9% |

| 18-20 Year Old Rate: | £6.83 | £7.49 | 9.7% |

| 16-17 Year Old Rate: | £4.81 | £5.28 | 9.7% |

| Apprentice Rate: | £4.81 | £5.28 | 9.7% |

Total Tax Deduction

The total Tax and National Insurance you will pay to HMRC on your £12,000 salary is £1,097.60 per year, £91.47 per month or £21.11 per week and £4.22 per day for the tax year 2023/2024. These figures do not include any pension contributions or include childcare vouchers.

Pension Payments From £16,000 per year

In the UK, most employees are automatically enrolled in a pension scheme, with a default contribution rate of 5% from the employee and an additional 3% from the employer.

Your pension is calculated on your gross salary, not your net salary If you’re on the auto-enrolment pension scheme, you will contribute £800 annually towards retirement.

In practical terms, this means setting aside just £66.67 each month or as little as £15.38 every week.

Your employer contributes an extra £480 to your pension pot every year. That’s an additional £40 per month or £9.23 per week.

Student Loan Repayments For £16k Per Year

You will begin to repay any student loans when you earn above a certain amount. The table below will show how much you can expect to repay based on your £16,000 per year salary.

| Repayment Plan | Earnings Threshold | Rate | Notes |

|---|---|---|---|

| Plan 1 | £22,015 | 9% | Most Common |

| Plan 2 | £27,295 | 9% | |

| Plan 4 | £27,660 | 9% | Scotland |

| Plan 5 | £25,000 | 9% | From August 2023 |

| Postgraduate Loan | £21,000 | 6% | Additional |

If you need help determining your student loan plan, look at our student loan repayment guide. Alternatively, information is available from GOV.UK.

Important Note: Your calculation will differ if you are self-employed or live in Scotland. Use our salary calculator to work out your take-home pay.

£16,000 After Tax is How Much Per Month?

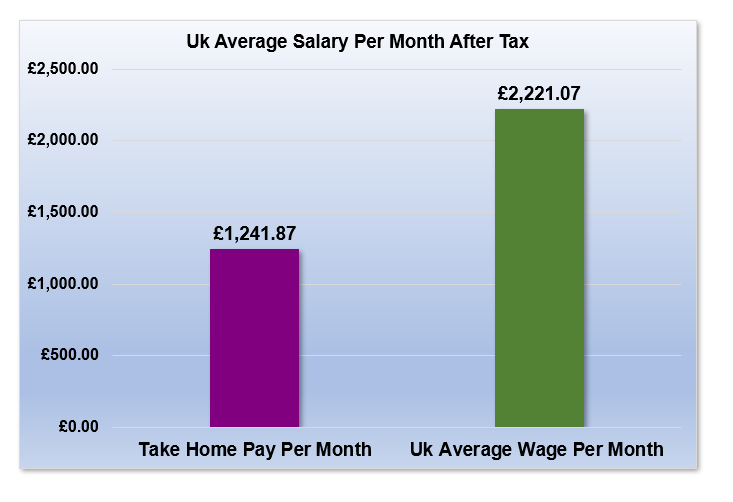

If you earn £16,000 per year after tax and national insurance contributions, you will have a net income of £1,241.87 per month for the tax year 2023/2024. This figure does not take into account any pension contributions.

£16,000 After Tax is How Much Per Week?

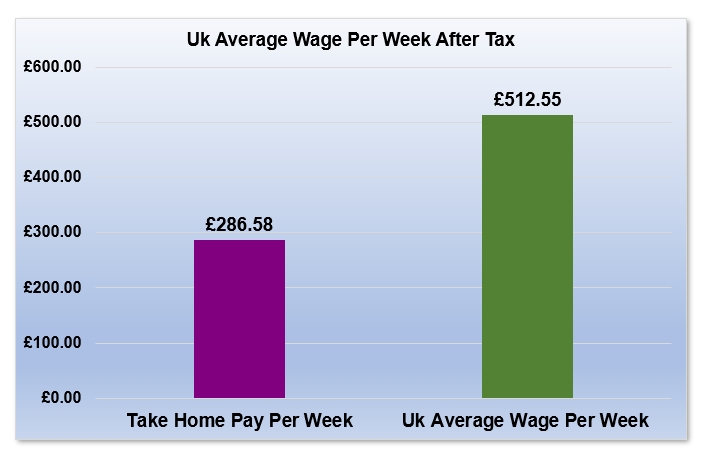

Say you earn £16,000 per year; after tax and national insurance, you will take home £286.58 per week for the tax year 2023/2024. This figure does not take into account any pension contributions.

Disclaimer: These figures are for guidance only and do not in any way constitute financial advice. The rates shown have been calculated for the tax year 2023/2024.